Starting and growing a business often requires access to capital. For many entrepreneurs, obtaining a business loan is a viable option to finance their ventures. In this article, we will explore how do business loans work and provide you with a comprehensive guide to understanding and navigating the process.

Introduction

Starting a business requires adequate funding to cover various expenses, such as purchasing inventory, leasing a space, hiring employees, or investing in equipment. Business loans offer entrepreneurs the financial support they need to kick-start their ventures or fuel their expansion plans.

Understanding Business Loans

What are Business Loans?

Business loans are financial products specifically designed to provide capital to businesses for various purposes. These loans are typically offered by banks, credit unions, online lenders, or other financial institutions. They come with specific terms, interest rates, and repayment schedules.

Types of Business Loans

There are several types of business loans available, each catering to different financial needs. Some common types include:

Term Loans

Term loans are traditional loans where borrowers receive a lump sum of money upfront and repay it over a predetermined period with fixed monthly payments. These loans are suitable for long-term investments or major expenses.

Equipment Financing

Equipment financing is a type of loan that specifically covers the cost of purchasing or leasing equipment for business operations. The equipment itself serves as collateral for the loan.

SBA Loans

SBA loans are guaranteed by the Small Business Administration (SBA) and offer competitive rates and flexible terms. These loans are ideal for small businesses and startups that may not qualify for traditional bank loans.

Lines of Credit

Lines of credit provide businesses with access to a predetermined amount of funds that can be withdrawn as needed. They offer flexibility and can be used for various purposes, such as managing cash flow or covering unexpected expenses.

Invoice Financing

Invoice financing, also known as accounts receivable financing, allows businesses to receive a cash advance based on their outstanding invoices. This type of loan helps improve cash flow by providing immediate funds that would otherwise be tied up in unpaid invoices.

Why Do Businesses Need Loans?

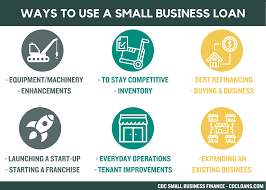

Businesses may need loans for several reasons, including:

- Startup Costs: Entrepreneurs often require capital to cover initial expenses when starting a business.

- Expansion: As businesses grow, they may need additional funds to expand operations, open new locations, or enter new markets.

- Inventory and Equipment: Loans can be used to purchase inventory, upgrade equipment, or invest in technology.

- Working Capital: Loans help businesses manage their day-to-day operations, cover payroll, or bridge cash flow gaps.

- Emergency Expenses: Unforeseen circumstances or emergencies may require immediate financial support.

Qualifying for a Business Loan

Before obtaining a business loan, it’s important to understand the qualification criteria set by lenders. While requirements may vary, some common factors considered during the evaluation process include:

Credit Score and History

Lenders often assess the creditworthiness of businesses and business owners. A strong credit history and a high credit score increase the chances of loan approval and favorable terms.

Financial Statements

Lenders analyze financial statements, such as income statements, balance sheets, and cash flow statements, to assess the financial health and stability of a business.

Business Plan

A comprehensive business plan outlines the objectives, strategies, and financial projections of a business. Lenders review business plans to evaluate the viability and potential for success.

Collateral

Some lenders require collateral to secure a loan. Collateral can be in the form of assets, such as real estate, equipment, or inventory, that can be seized if the borrower defaults on the loan.

Cash Flow

Lenders consider the cash flow of a business to ensure it has the ability to repay the loan. Positive and consistent cash flow increases the likelihood of loan approval.

The Application Process

Once you have determined your eligibility and prepared the necessary documentation, it’s time to navigate the business loan application process. Here are the steps involved:

Research and Preparation

Before applying for a loan, conduct thorough research to understand the different loan options available and identify the most suitable one for your business needs. Prepare the necessary documents, such as financial statements, tax returns, and business licenses.

Choosing the Right Lender

Selecting the right lender is crucial. Consider factors such as interest rates, repayment terms, customer reviews, and eligibility criteria. You may choose to work with traditional banks, credit unions, online lenders, or alternative financing options.

Gathering Documentation

Gather all the required documents, which may include business and personal financial statements, tax returns, bank statements, legal documents, and a business plan. Make sure the information is accurate and up to date.

Submitting the Application

Fill out the loan application form provided by the lender. Double-check all the information before submitting it. Incomplete or inaccurate applications may lead to delays or even rejection.

Approval and Funding

After submitting the application, the lender will review it and assess your creditworthiness, financial health, and business viability. If approved, you will receive a loan offer outlining the terms, interest rates, and repayment schedule. Upon acceptance, the funds will be disbursed to your business account.

Loan Repayment

Once you receive the loan, it’s essential to understand the repayment terms and fulfill your obligations. Here are some key considerations:

Interest Rates and Terms

Loan agreements specify the interest rates, repayment period, and frequency of payments. Understand the terms and calculate the total interest paid over the life of the loan.

Repayment Options

Lenders may offer various repayment options, such as monthly, bi-weekly, or quarterly payments. Choose a schedule that aligns with your cash flow to avoid defaulting on the loan.

Early Repayment

Some loans allow early repayment without penalties. Paying off your loan early can save you money on interest payments and improve your credit score.

Impact on Credit Score

Timely loan repayments positively impact your credit score, making it easier to secure future financing. On the other hand, missed payments or defaults can have a negative impact.